New Jersey Foreclosure Process 2024

by denbeaux & Denbeaux

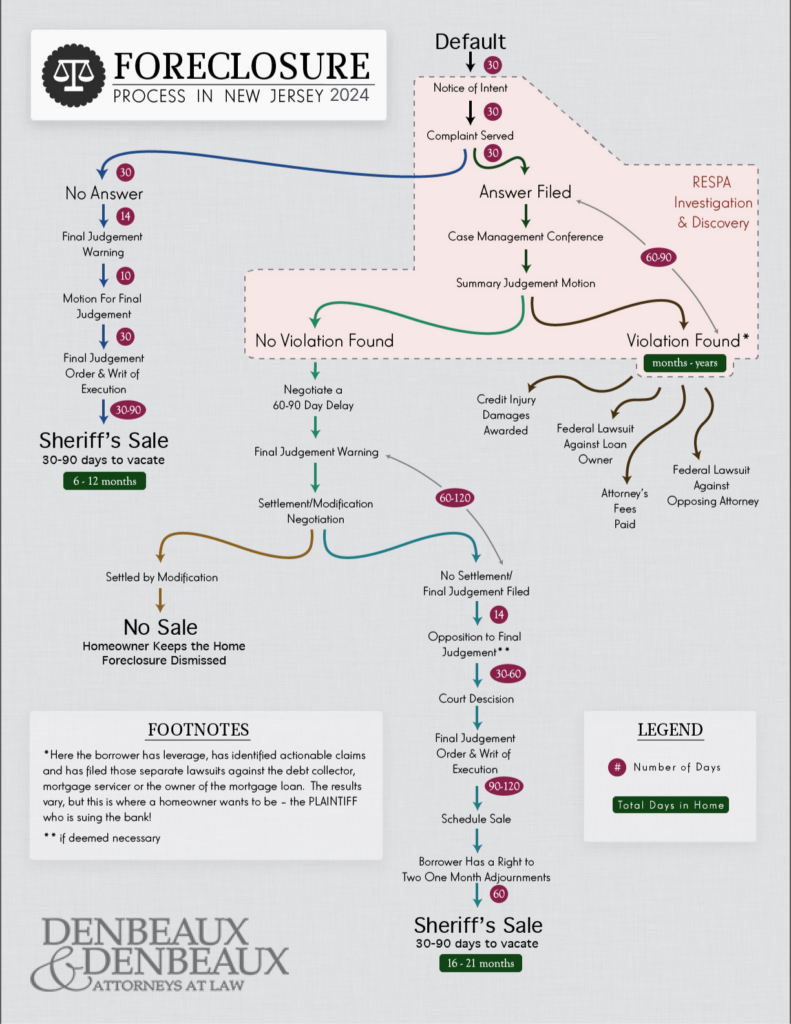

NJ Foreclosure Infographic

This image illustrates how the system works in favor of those fighting foreclosure and, more importantly, the absolute necessity of proper investigation of the mortgage servicer’s actions throughout the history of the loan (RESPA Investigation & Discovery).

Fighting the foreclosure buys time … lots of time.

Uncovering mortgage servicing mistakes buys leverage … lots of leverage.

You can see that just by Answering the Complaint, you guarantee yourself more time in your home. We explore everyone’s unique situation and help you decide the best course of action.