NEW JERSEY LOAN MODIFICATION ATTORNEY

Loan Modification

Loan Modification Legal Help

Loan Modification Attorneys

We understand how hopeless it can seem the stresses that the possibility of losing your house can cause you and your family. Debt and the threat of losing your home is often a temporary situation that you could solve with the right loan modification agreement. Having the right loan modification attorney on your side can help.

Josh Denbeaux is an experienced attorney who is familiar with New Jersey loan modification laws and works to help his clients keep their homes.

You shouldn’t have to worry about losing your home or facing foreclosure all on your own. Call (201) 970-6534 for a free phone consultation today.

Free Loan Modification Consultation

New Jersey Counties We Serve

How Loan Modification Works

Strategies for Loan Modification

What Is a Mortgage Loan Modification and How Does it Work?

A loan modification is a change in your mortgage terms. Unlike a forbearance agreement—a temporary suspension of your interest rate—a loan modification is a long-term solution that could involve lowering your interest rate, extending the terms of your mortgage, a reduction in the principal balance, a substitution of a different type of loan (such as going from a variable interest rate to a fixed rate) or a combination of these.

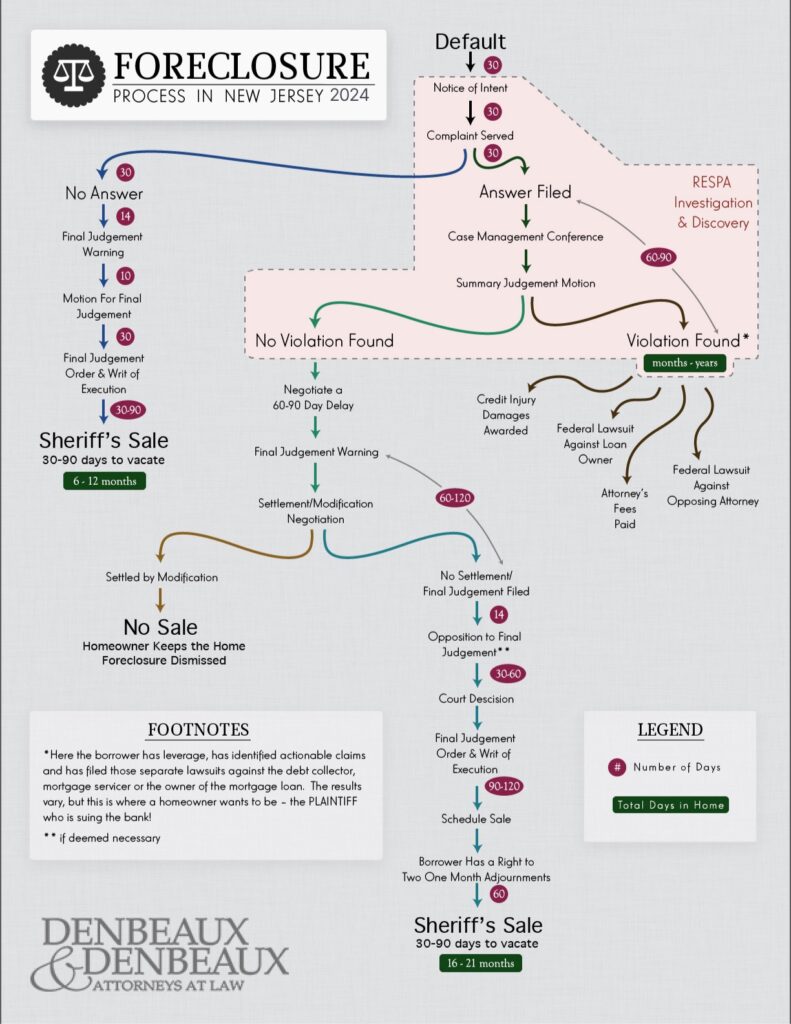

If you are at risk of losing your home to foreclosure in New Jersey, a NJ mortgage modification may be able to stop the foreclosure by reducing the amount of monthly payments and lengthening your mortgage term.

Develop Your Loan Modification Strategy

Facing loan modification alone can be overwhelming. Understanding loan modifications rules and regulations can leave you feeling hopeless if you’re not familiar with the right strategy to take. A successful loan modification begins with a Loan Modification Strategy Session with Joshua Denbeaux.

It’s a three-step process. We start with a Loan Modification Strategy Session. Joshua Denbeaux and our loan modification advisor will meet with you to go over the terms of your mortgage and your full financial situation. Next, we’ll formulate a plan.

A loan modification strategy may include:

- What loan modification you are entitled to and how to get that modification.

- Whether the loan modification you are entitled to is actually right for you and if not, an alternative plan.

- A foreclosure defense plan if you are not entitled to a loan modification.

Our goal for working with every client is when you come out of this Loan Modification Strategy Session, you feel a sense of relief that comes with having a plan that you understand and feel comfortable with. With a strategy in hand, it’s time to fight for your home.

We uphold homeowner rights to make sure the banks play by the rules. Call today to see how an experienced loan modification attorney by your side can help you protect your home.

The Denbeaux and Denbeaux Advantage

At Denbeaux and Denbeaux, partner Joshua Denbeaux personally conducts every Loan Modification Strategy Session. At the strategy session, you can rest easy knowing you’re getting the best advice from the most experienced loan modification lawyer in the state. We know the laws and regulations and we’ll know if your lender is—or isn’t—following them.

You need an advocate on your side who’s not afraid of lenders, one who will stand up for you when you’re facing foreclosure. That’s why you need Denbeaux and Denbeaux.