Debt Collection is $14.5 Trillion Industry as of 2019 and it’s growing. Laws protect consumers by regulating how businesses and consumers handle the credit and debit transaction business. That way both the company and the consumer get fair treatment. By understanding the laws, you are better able to protect yourself.

For the consumer, laws work to ensure their record of credit report is accurate in the marketplace. For businesses, the laws help them recover missed payments for goods and services provided.

We reviewed the 2020 Annual Report on the Fair Debt Collection Practices Act, prepared by The Bureau of Consumer Financial Protection (Bureau or CFPB) and the Federal Trade Commission (Commission or FTC). We excerpted sections below that are highlights.

To summarize the Report, the CFPB and FTC only process a fraction of the violations and collect a fraction of the penalties. Thus, making the debt collection industry ripe for deceptive, abusive, and unfair practices. Some people try to collect money from anyone with a phone number. It’s that simple. Consumers need to act independently. Not rely on the CFPB to find, prosecute, and enforce their consumer rights for them.

The CFPB Fights Back

“The Bureau received approximately 75,200 complaints about first-party and third-party debt collection in 2019, making debt collection one of the most prevalent topics of consumer complaints. In 2019, the Bureau engaged in five public enforcement actions, two of which were initiated in years prior to 2019, arising from alleged FDCPA violations. The Bureau resolved two of these cases and obtained partial consent judgments in a third. These judgments ordered nearly $50 million in consumer redress and $11.2 million in civil money penalties. Penalties paid to the Bureau are held in its Civil Penalty Relief Fund, which is used to provide relief to eligible consumers who would not otherwise receive full compensation. Three cases remain in active litigation. The Bureau also filed briefs amicus curiae in four cases arising under the FDCPA: one in the Supreme Court and three in federal courts of appeals.”

– Message from Kathleen L. Kraninger, Director of the CFPB, March 2020 Fair Debt Collection Practices Act CFPB Annual Report 2020

Total penalties of $61.2 million for 75,200 complaints would equal an $813.83 payment per complaint. The statutory penalty is at least $1,000.00 for an FDCPA complaint. Making the Bureau not as useful for the consumer as it could be.

THE FTC Fights Back

The FTC puts unscrupulous debt collectors out of business.

“In 2019 alone, the FTC filed or resolved debt collection cases against 25 defendants and obtained more than $24.7 million in judgments. It also secured permanent bans against 23 companies and individuals who engaged in serious and repeated violations of law, barring them from ever working in the debt collection arena again. “ – Message from Joseph J. Simons Chairman of the FTC

The CFPB and the FTC collected $ 85.9 million of penalties in damages in 2019.

In a $14 trillion dollar market, $85.9 million of penalties is .06%. That is a penalty of less than a penny for collecting $100. Meaning, for unlawful debt collectors, the risk, if caught, for every $100,000 collected, the cost is $60 in penalties.

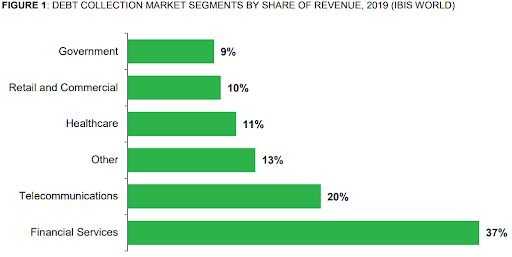

Industry Breakdown

Most consumers with collection tradelines on their credit files have medical, telecommunications, or banking and financial services debt. Financial services debt is the largest revenue source for the debt collection industry; it accounted for approximately 40 percent of debt collection revenue in 2019.

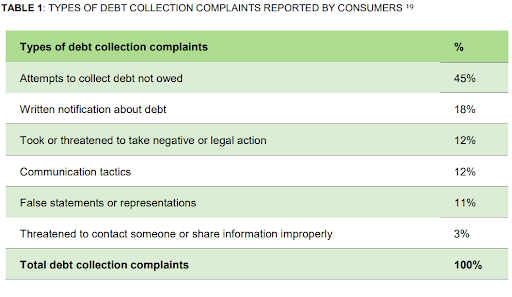

Types of Complaints Handled

From January 1, 2019, through December 31, 2019, the Bureau received approximately 75,200 debt collection complaints. That is a decrease of roughly 8% compared to 2018.

Attempts to Collect a Debt Not Owed

The most common debt collection complaint continues to be about attempts to collect a debt that the consumer reportedly doesn’t owe. Of these complaints about debts consumers think they do not owe, consumers said that the debt

- is not their debt (48 percent),

- resulted from identity theft (25 percent),

- already paid (22 percent),

- or discharged in bankruptcy and is no longer owed (4 percent).

Written Complaints

Complaints involving written notifications about debt are the second-most common issue selected by consumers (Table 1, line 2). The FDCPA requires collectors, within five days after the initial communication with a consumer, to provide the consumer with a written notice informing them, among other things, of their right to dispute, unless the initial communication contained that information or the consumer paid the debt.

Most consumers who complain about written notifications (65 percent) report they have not received enough information to identify and confirm ownership of the debt .

Legal Threats

Consumers submitted complaints describing companies taking or threatening to take adverse or legal action (Table 1, line 3).

Most of these complaints are about threats

- of damage to a consumers’ credit history (34 percent),

- to sue on a debt that is old (28 percent), or

- to arrest or jail consumers if they do not pay (14 percent).

Among these issues, threats to arrest or jail consumers had the most significant decrease in the total percentage of yearly complaints (with 14 percent of the annual complaints in 2019 down to 19 percent in 2018).

Other Complaints

Other complaints relate to

- suing without proper notification of the lawsuit (9 percent),

- seizures or attempts to seize property (8 percent),

- collection of or attempts to collect exempt funds such as child support or unemployment benefits (5 percent),

- suing in a different state from where the consumer lives or where the consumer signed the contract (2 percent), or

- threats of deportation or turning the consumer into immigration (0.2 percent).

Communication Tactics

Consumers also submitted complaints about communication tactics used when collecting debts (see line 4 of Table 1). The majority of complaints about communication tactics concern communication held over the phone, such as

- Frequent or repeated calls (55 percent).

- Complaints of continued contact attempts despite requests to stop contact were also common (29 percent).

- Other communication tactics complaints relate to reports of companies using obscene, profane.

- Abusive language (12 percent) or

- Calling outside of the hours from 8:00 a.m. to 9:00 p.m. at the consumer’s location (5 percent).

False Statements or Representations

The majority of complaints about false statements or representations (Table 1, line 5) are about attempts to

- Collect the wrong amount from the consumer (74 percent).

- Consumers also report that companies impersonated an attorney, law enforcement, or government official (17 percent),

- Indication the consumer committed a crime by not paying a debt (6 percent), or

- Suggestion that the consumer should not respond to a lawsuit (3 percent).

Threats to Share Information Improperly

Complaints about threatening to contact a third-party about a debt or sharing information improperly were the least complained about debt collection issue in 2019 (Table 1, line 6). In these complaints, consumers most often reported that the collector

- talked to a third party about the debt (53 percent),

- contacted an employer (28 percent),

- made contact with the consumer after being asked not to do so (18 percent), or

- reached the consumer directly, instead of contacting their attorney (2 percent).

In summary, every letter of the law is violated at one point or another by unscrupulous companies. This is because the risk of a severe penalty is low. Not all companies are bad actors, and not all bad actors get caught.

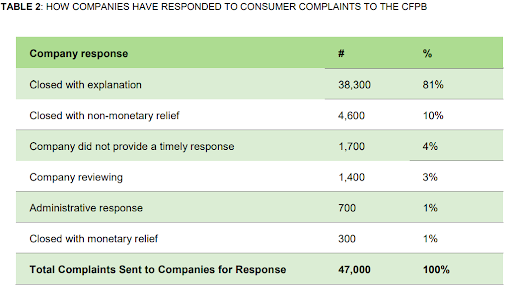

How Companies Respond to Consumer Complaints

From January 1, 2019, through December 31, 2019, the Bureau sent approximately 47,000 (63 percent) of roughly 75,200 debt collection complaints it received to companies for their review and response.

Refer to Regulatory Agencies

Debt collection complaints may relate to first-party (creditors collecting on their own debts) or third-party collections. When the Bureau received debt collection complaints about companies where it was not the primary federal regulator (e.g., a mobile phone or Internet service provider) or about depository institutions with less than $10 billion in assets, it referred the complaints to other regulatory agencies.

In 2019, the Bureau referred approximately 29 percent of debt collection complaints to other regulatory agencies. The complaints the Bureau did not send to collectors for a response or refer to other agencies were either incomplete (7 percent), pending with the consumer (0.6 percent), or pending with the Bureau (0.7 percent).

Company Responses

Companies responded to approximately 44,400 complaints or 94 percent of the about 47,000 complaints sent to them in 2019 for a response. Company responses generally include descriptions of steps taken or that will be taken, communications received from the consumer, any follow-up actions or planned follow-up actions, and categorization of the response. Response category options include “closed with monetary relief,” “closed with non-monetary relief,” “closed with explanation,” and other administrative options.

Monetary relief is objective, measurable, and verifiable financial relief to the consumer due to the steps taken or that will be taken in response to the complaint. Non-monetary relief is defined as other objective and verifiable relief to the consumer due to the steps taken or that will be taken in response to the consumer’s complaint. “Closed with explanation” indicates that the company’s actions in response to the complaint included a tailored explanation to the individual consumer’s complaint. For example, use this category when no monetary or non-monetary relief is provided to the consumer, and the response substantively meets the consumer’s desired resolution or explains why they won’t take further action.

The Bureau gives consumers the option to review and provide feedback on all company closure responses, which it then shares with the responding company upon receipt.

How Companies Have Responded to Consumer Complaints

Although consumers brought these complaints to the Bureau, very few cases were closed with monetary relief for the size of a $14.0 trillion market.

The major areas of the complaints registered are:

- A false representation of the amount and legal status of the debt.

- Failure to disclose in subsequent communications that communication is from a debt collector.

- Failure to send notice of the debt.

CFPB Education and Outreach

Like the mission of Denbeaux & Denbeaux, the “Bureau provides consumers with information about specific financial topics, including those relating to debt collection. A major Bureau consumer education product is Ask CFPB. It’s an interactive online tool that helps consumers find clear answers to a wide variety of financial questions.

In October 2012, the Bureau began publishing “Ask CFPB” content, including questions and answers on the topic of debt collection. From its beginning until December 2019, “Ask CFPB” has more than 26.9 million views. Debt collection is consistently one of the two categories with higest view in Ask CFPB. It includes practical tips to consumers regarding steps they can take when faced with debt collection. As well as steps to manage debts in a way that may prevent the debts from ending up in collection.

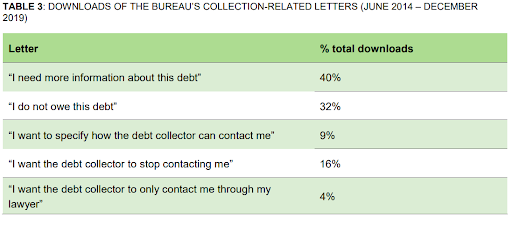

Sample Letters

The Bureau has added five sample letters to “Ask CFPB” that consumers may use when interacting with debt collectors. The five letters are for consumers who:

- Need more information about a debt.

- Want to dispute their debt

- Are looking to restrict how and when a collector can contact them.

- Are trying to stop all communication from the debt collector.

- Want to direct further communications concerning the debt matter to an attorney.

Sixty of these letters are available in English and Spanish, The letters have more than 661,000 downloads from June 2014 to the end of December 2019. The two most downloaded letters are “I need more information about this debt” and “I do not owe this debt.”

Here is where you can get the five sample letters to send debt collectors. CFPB states that these letters are not legal advice and to keep copies of any letters sent.

That is good advice. Better advice is to talk to an attorney about your debt collection harassment.