STOP DEBT COLLECTOR HARASSMENT

Debt Collection Defense

Facing Debt Collections?

Debt Collection Defense Attorney

Have you experienced debt collector harassment? Maybe you have received numerous phone calls, voicemails, or letters in the mail about your debt. Dealing with financial stress is hard enough. Debt collectors seem to make it even worse. It can be especially stressful if you’re not actually in debt but collections is harassing you for money you don’t owe.

Having the right debt defense attorney can help stop debt collectors from calling or contacting you. Denbeaux and Denbeaux is an experienced debt collection lawyer who can help maintain your debt collection rights and work to make sure they are upheld. Contact us today to see how we can help stop debt collectors from harassing you.

Free Debt Collection Defense Consultation

Facing debt collection lawsuits or harassment? Contact us today for a free initial consultation to learn about your options for debt collections and fair debt collection practices.

Fair Debt Collections Practices Act

Understanding Your Rights

How to Stop Debt Collectors Harassment

If you’ve dealt with threatening and intimidating calls and letters from debt collectors you may be wondering how to stop the harassment. The Fair Debt Collection Practices Act (FDCPA), provides rules that debt collectors must follow when attempting to collect debt. This includes the rule that debt collectors cannot legally contact you once you advise them that you’ve hired an attorney.

More rules that fall under the FDCPA include:

- A debt collector MUST write to you within FIVE DAYS of the first call you receive to tell you in writing: the amount of the alleged debt, the alleged creditor of the debt, and how you can dispute this debt

- A debt collector MAY NOT call you on your cell phone after you tell them to stop using your cell phone

- A debt collector MAY NOT try to collect money from you when you are in bankruptcy

The FDCPA can be a very powerful tool if invoked and can potentially get rid of debt collector harassment. However, the calls may not always stop even if you attempt to stop them yourself. Hiring the right debt lawyer may help handle your creditors so you don’t have to.

Hiring a Debt Collection Defense Attorney

Creditors can be hard to get rid of. You shouldn’t have to worry about tackling your financial debts and trying to stop collector harassment. Hiring a debt defense lawyer may make a difference in your case.

You have rights. If debt collectors are in violation of the FDCPA rules and regulations, you may be able to seek legal action against them. At Denbeaux and Denbeaux, we work hard for our clients to help them get on the path to financial freedom without embarrassing and harassing calls and letters. Contact us today to see how we can help stop your debt collector harassment!

Need Debt Defense?

Free Debt Collection Consultation

Facing harassment from debt collections?

Schedule a free initial consultation to learn about your options.

Free Foreclosure Resources

Download our guide on the New Jersey foreclosure process and strategies to stop or postpone foreclosure on your home as well as key information about how to protect your homeowner rights.

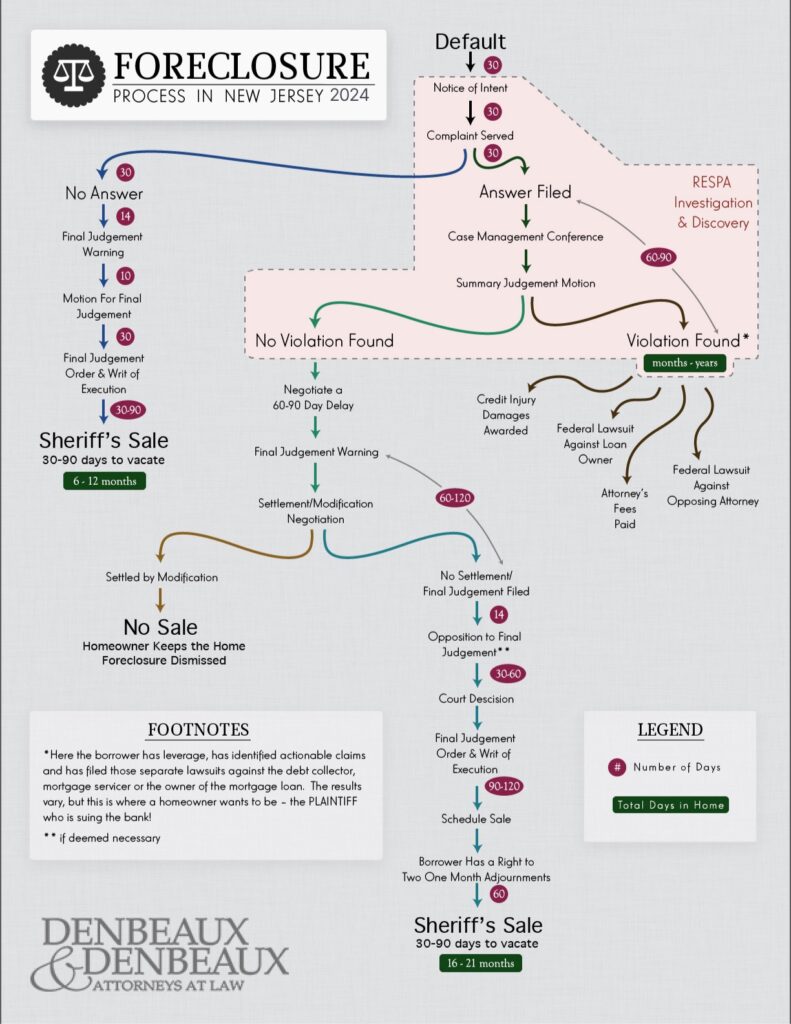

Learn the basics of the foreclosure process in New Jersey in this downloadable infographic that explains the process, timelines, and how your homeowner’s rights work in the process.

Questions about how foreclosure works and what your options are as a homeowner? Review frequently asked questions about the foreclosure process, bankruptcy, and loan modifications.