How Banks Think:

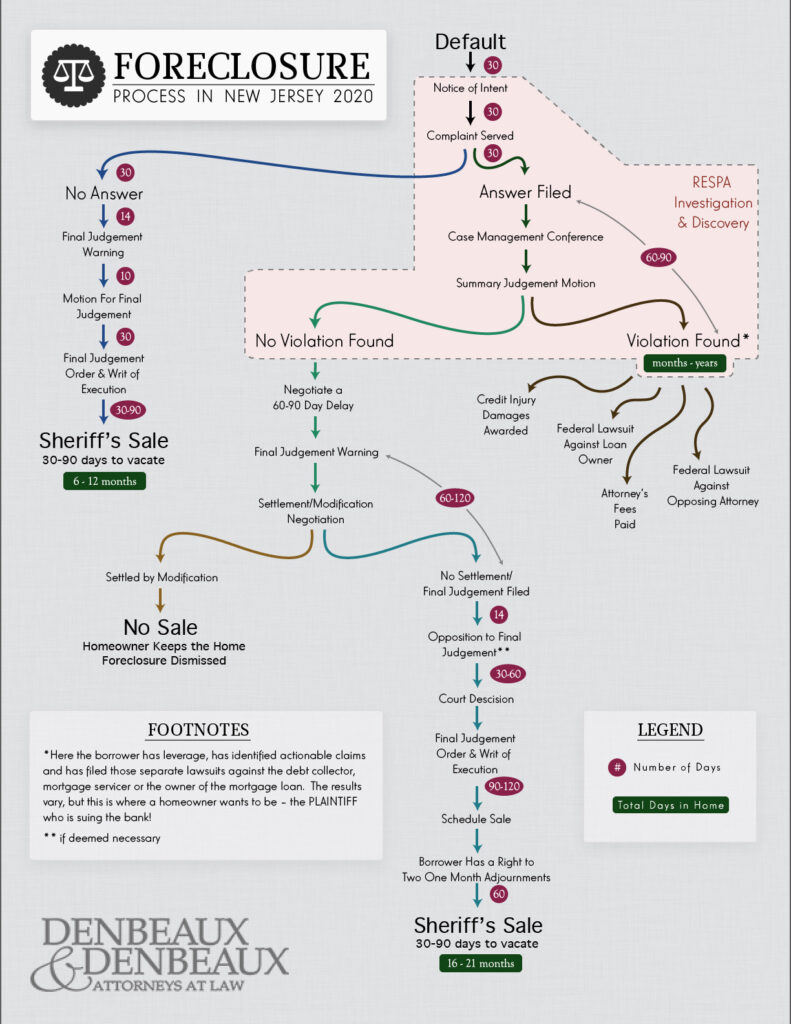

Banks know how the system works, how long it takes to ‘win’ a foreclosure case … how expensive it is to litigate a defended foreclosure case. You should know this, too, which is why I created the Foreclosure Infographic.

I’ve talked about this in my earlier newsletters and in several blog posts, so I will not belabor the point. Just keep in mind that it was created pre-pandemic, so the time periods in that document are too short.

The banks also know one more thing: It is only the first time you apply for a modification that the bank has to put the foreclosure on hold. After that, so long as the servicing does not change, a bank still has to review you for a modification but they do NOT have to stop pressing forward on the litigation and trying to take your home.

So when a bank looks at a homeowner in foreclosure, they think: If I can get this person to apply for a modification right away … and convince them not to Answer the Complaint … then I am definitely on the right track here.

It is an ugly trap and it depends on the bank knowing more than you about how foreclosure works and convincing you to panic and act immediately, when in reality, you should not do that. The banks go into a foreclosure with a plan, and so should you.

Let’s review:

- Foreclosures take a long time if you Answer the Complaint;

- A bank must put the whole foreclosure on hold when reviewing your first modification application.

How do you break the bank’s foreclosure strategy?

It’s easy as 1, 2, 3:

- Answer the Foreclosure Complaint and you retain the right lawyer to fight back;

- Use the very extended time it takes banks to actually complete a contested foreclosure to gather your finances in order, deal with your pain in the neck credit card/car loan debt you have that has been weighing you down for years;

- Apply for modification when it works for you.

And there is another key piece of information that the banks all know, and that a few good consumer rights attorneys know: that federal law requires a bank to consider a loan modification at any time, including right before the ‘end’.

The point is … you have time, and time is money.

Essentially, you can use the foreclosure filing to extend the time when you are in the home without having to pay a housing payment. You can use that time – look at the infographic and you will get an idea of how much time – to get your financial ‘house’ in order, and then, if you have not won the litigation can apply for a modification after your finances are back in shape and you have dealt with the unsecured debt that has been plaguing you before the pandemic.

But really, think of it this way: Banks think strategically. Why shouldn’t you?

The thing you need to understand, first and foremost, is how the New Jersey foreclosure system works. Really works. To that end I need you to go look at the foreclosure infographic that lays out the foreclosure process.

There are going to be a lot of people in financial pain. There are a lot of people struggling to pay bills today, and it is likely to get worse.

Most people are in a temporary – maybe extended but still temporary – financial strain. It is going to get better, eventually.

At the same time, the foreclosure system in New Jersey is, for all intents and purposes today, broken.

The modification programs, though, they are pretty much operational. Modification can be applied for at any time during the process, even right before a sheriff sale.

Before my readers get all upset at that thought – because it is very upsetting – please look at the foreclosure infographic I put together in January. If this is the first time you are reading my blog, this might be the first time you have had anyone lay out to you – straight up – the timeframes in New Jersey foreclosure litigation.

But please keep in mind that those time frames I put into that document are pre-pandemic timeframes. Reality today is even after foreclosures are recommenced, the time it will take banks to truly foreclose and get to sale are going to be significantly extended even beyond the timeframes I put into that document.

If you defend yourself!

Which everyone, EVERYONE, should absolutely, completely do.

Fight back.