What is RESPA and how does it relate to your mortgage, your FHA Forbearance, and the CARES Act?

The Real Estate Settlement Procedures Act (RESPA) is the federal statute that governs the mortgage servicing industry and protects your rights under the CARES Act.

It is an extremely complex and nuanced statute such that few New Jersey attorneys have experience prosecuting RESPA violations.

Under RESPA, mortgage servicers are prohibited from violating the law (and being unfair and abusive) during mortgage servicing. However, actually bringing a claim even after a violation is discovered is not so simple.

A Consumer Rights Attorney can do this for you, usually for a fee. You can also protect yourself with only the cost of mailing a single letter. I will walk you through what you need to know.

What you need to know about claiming a CARES Act violation:

Before you can sue a mortgage servicer for violating your rights, you MUST serve the mortgage servicer with a letter that:

- Explains what the violation is and

- Tells the servicer how you want the violation fixed and

- It gives them time to solve the problem.

Note: In some cases, depending on the violation, you must serve the loan owner as well.

The letter must be in writing. Since many of these letters go missing, it must be sent via Certified Mail, Return Receipt Requested. Send it to the address that each mortgage servicer identifies as the only valid address for service of a Notice of Error.

This is a very complex and nuanced statute. It is the only statute available to protect your rights under the CARES Act.

How does the CARES Act Forbearance impact your mortgage?

Under The CARES Act, if you have an FHA backed mortgage, you have the right to a grace period of your mortgage payments – known as CARES Act Forbearance. During this time the mortgage servicer may NOT report you to the Credit Reporting Agencies.

Mortgage servicers may not implement the proper procedures to protect your credit rating during your forbearance period. That, when it happens, will be a violation of the rights of every borrower affected.

What you can do if you’re facing a CARES Act violation:

In order to help people who face this problem, I am providing a copy of the Notice of Error letter. Copy the letter, insert the name of your mortgage servicer, your account number and your name and address.*

The letter must be sent only to the address that your mortgage servicer has set aside for receiving Notices of Error.

In order to make this process even more complicated and difficult, mortgage servicers change this address from time to time. You must use the latest address listed by the mortgage servicer to send your Notice of Error. Here is how to find the most recent and correct address.

*A Consumer Rights Attorney can do this for you but usually for a fee. You can also protect yourself for the cost of mailing a Certified Return Receipt letter.

How to ensure you serve a notice to the correct address:

RESPA requires the servicer to publicize the address for accepting the Notice of Error and making it easy to find. You can find the address by:

- looking at the mortgage statement you get every month. The address will be in small print on the back of one of the pages

- finding the latest and most correct address on Google search

How to Use Google search to find the correct mailing address to send a Notice of Error to a mortgage servicer:

- Let’s use Bank of America one of the largest mortgage servicers in the country as an example. Do a Google search on ‘Bank of America Notice of Error’ and you will probably get to this page:

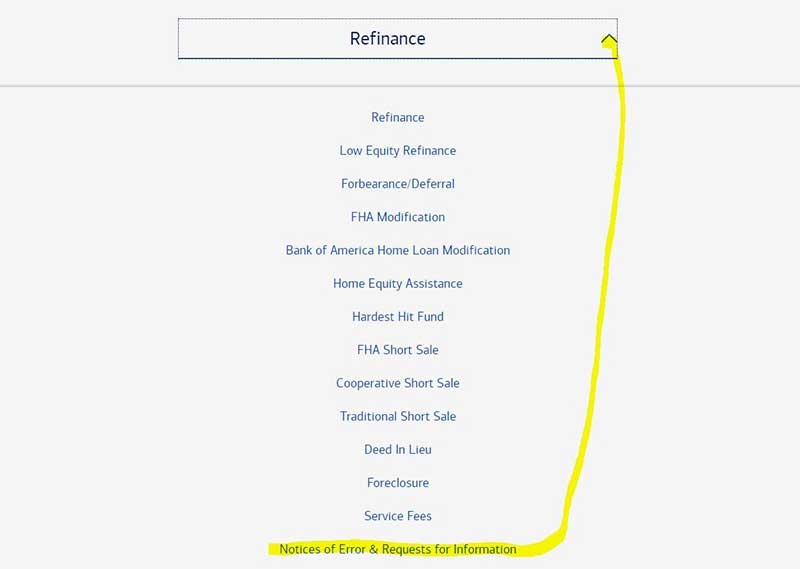

- Click on the down arrow ( which we have highlighted in yellow) to the right of Refinance. You will see a Menu of the FAQs that Bank of America makes available. In this case, it is the last item on the Menu at the end of the list of FAQs.

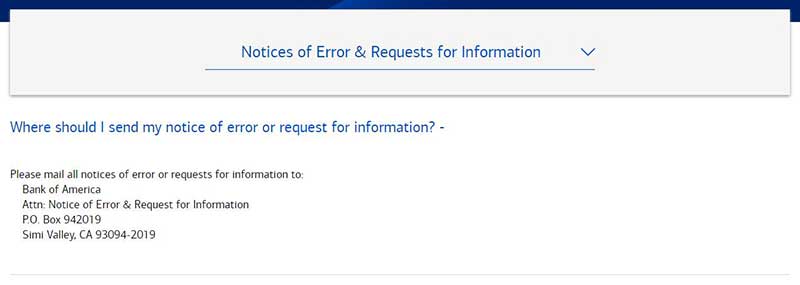

- Click on ‘Notices of Error & Requests for Information’ and you should see the correct and most latest address to mail the Notice of Error:

Please, do not rely on the above. Search for the current address as Bank of America can change this address at any time!

Once you are sure you have the correct address:

Print the letter, sign it, and send it via Certified Mail, Return Receipt Requested and await a response. If, after 30 days, you do not have a satisfactory solution, you are ready to talk to a consumer rights attorney. Any attorney of any experience in the area will give you a free consultation and, if you have a claim, will take it on a contingency arrangement.