NJ law firm Denbeaux & Denbeaux says continued mortgage-servicing problems, such as breached loan modification agreements, play a major role in why the state leads the nation in foreclosures, and is the cause for the recent RealtyTrac report which revealed that NJ has highest foreclosure rate in the U.S.

New Jersey consumer rights and foreclosure defense lawyer, Adam Deutsch, Esq., of the law firm Denbeaux and Denbeaux has noticed a significant increase in the number of homeowners pushed into foreclosure and collections due to the conduct of the mortgage servicer rather than the borrower’s ability to pay.

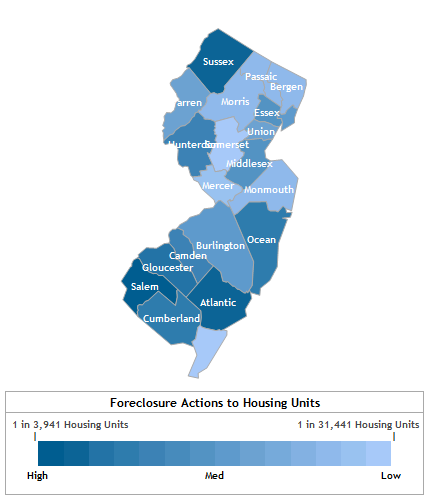

A recent report by RealtyTrac reveals that as of the third quarter of 2015, New Jersey has again claimed the highest foreclosure rate in the United States. The report also states that foreclosure activity in New Jersey has increased 27% from this time last year. Among those not surprised by the RealtyTrac findings is Denbeaux & Denbeaux Senior Associate Attorney Adam Deutsch.

UPDATE 10/18/16 : As of September 2016 , foreclosure rate for New Jersey was the highest in the country with 1 in every 544 homes

“I have noticed a large increase in the number of homeowners with loan modification problems,” said Deutsch. “Clients believe they have resolved their foreclosure issues by agreeing to a loan modification, only to discover that after a few months their servicer has breached the agreement. Some servicers stop accepting loan modification payments; others manipulate the rate payments so that the homeowners are paying more than agreed upon. A third pattern is that servicing of the loan is transferred and the new company refuses to honor the agreement.”

Deutsch surmises that the 27% jump in NJ foreclosures since this time last year may also have something to do with the recent increase in mergers in the mortgage servicing industry. The changing business models brought on by the mergers could be forcing homeowners into foreclosures that did not exist previously. Regardless of the issue, Deutsch instructs homeowners to seek legal counsel sooner than later.

“Time is on the side of the homeowners, but only if they take action. In the past, I saw many borrowers talking to their loan servicer and passively trusting that wrongful conduct would be corrected. They would only come to us after years of being misled. Amendments to federal laws that became effective in early 2014 have resulted in new opportunities to obtain meaningful relief for borrowers who have been lied to, injured, or otherwise harmed in the loan servicing and collection process. Unfortunately, the banking industry continues to abuse borrowers, and borrowers have not been made aware that they can sue the bank to enforce their rights.. These federal laws can have major impacts on a homeowner’s case, from issues relating to loan origination, misapplication of interest rates and escrow charges in loan servicing, and improper debt collection efforts. Relief has to be sought quickly, with some statutes having time limits as short as one year. This is why it is so important to keep good records and speak to a knowledgeable attorney as soon as the borrower thinks there is a problem.” Deutsch concluded.